Which of the Items Below Is Not a Business Entity

Which of the items below is not a business entity. An entity that is organized according to state or federal statutes and in which ownership is divided into shares of stock is a A.

Business Records To Track Types Of Records Why To Track Them

How its structured affects how taxes are paid and how liabilities are determined.

. Which of the items below is not a business entity. Which of the items below is not a business entity. Corporations are business entities owned by one person or many people called shareholders.

Although a sole proprietorship is not a separate legal entity from its owner it is a separate entity for accounting purposes. Which of the following accounts is a liability. Limited liability companies corporations partnerships and.

Which of the items below is not a business entity. Business entity categories refer to the type or structure of a business not what it does. Answer Venture entrepreneurship Proprietorship Partnership Corporation.

Service company is a business entity that provides services to the public and does not sell a product. Where the proposed entity intends to do business in relation to an existing business entity. Business entities are created at the state level often by filing documents with a state agency such as the secretary of state.

Partnerships are business entities owned by at least two people. It is not incorporated so that the sole owner is entitled to the entire net worth of the business and is personally liable for its debts. 1 an association taxed as a corporation 2 a partnership 3 a disregarded entity or 4 a trust.

Financial activities of the business eg receipt of fees are maintained separately from the persons personal financial activities eg house payment. LLC owners are called members. Which of the items below isnota business entity.

The primary types of business entities are as follows along with their advantages and disadvantages. On May 20 White Repair Service extended an offer of 108000 for land that had been priced for sale at 140000. So the entrepreneurship is not a item of business entity.

In this case the business entity and the count as one and the same. A business jointly owned and operated by a married couple is a partnership and should file Form 1065 US. The statement of cash flows is.

Four financial statements are usually prepared for a business. Asked in Other Sep 10 2021 36 views. Sole Proprietorships are business entities owned by one single person.

Under the check-the-box entity-classification regulations an organization that is recognized for federal tax purposes as an entity separate from its owners can potentially be classified as. Unless a business meets the requirements listed below to be a qualified joint venture a sole proprietorship must be solely owned by one spouse and the other spouse can work in the business as an employee. Which of the items below is not a business organization form.

Accounts Payable Service Revenue Accounts Receivable Wages Expense The ending balance of the retained earnings account appears in both the retained earnings statement and the statement of cash flows both. Which of the items below is not a business entity. Which of the following is not an asset.

Get Answers Chief of LearnyVerse. Entrepreneurship proprietorship partnership corporation. Often the owner of a single-member limited liability company or a sole proprietorship only needs to file a single tax return.

Subject to the requirements found in California Corporations Code section 2106 the purpose of a business entity. 231k points 59 586 1857. An entity that is organized according to state or federal statutes and in which ownership is divided into shares of stock is a.

On May 30 White Repair Service accepted the sellers counteroffer of 115000. Trusts are not considered business entities see Regs. Which of the items below is not a business entity.

Hence the correct option is A. A sole proprietorship is a business that is directly owned by a single individual. Mostly sole trader-ship employs few employees and does have not many business.

Business entities are often subject to taxation so the business owners must file a tax return for those businesses. Corporation proprietorship partnership entrepreneurship. The people who run an LLC are called managers.

Experts are tested by Chegg as specialists in their subject area. There are important flavors of each class of business entity. Sole Traders or sole trader-ship are the types of business entities that own run and are managed by mainly one person.

Return of Partnership Income unless the. A limited liability company LLC is a unique form of business entity. Which of the items below is not a business entity.

Whether or not an existing business entity is actively engaged in business or has a telephone listing or a location or place of business. The following is the list of types of business entities. The list contains four types of business including Sole Trader 1 Sole Trader.

There are four broad groups of business entities. The concept of business entity in accounting is applicable to the all kinds of business organization which are partnership proprietorship and corporation. On May 20 White Repair Service extended an offer of 108 000 for land that had been priced for sale at 140 000.

Who are the experts.

How To Calculate Cost Of Goods Sold Bench Accounting

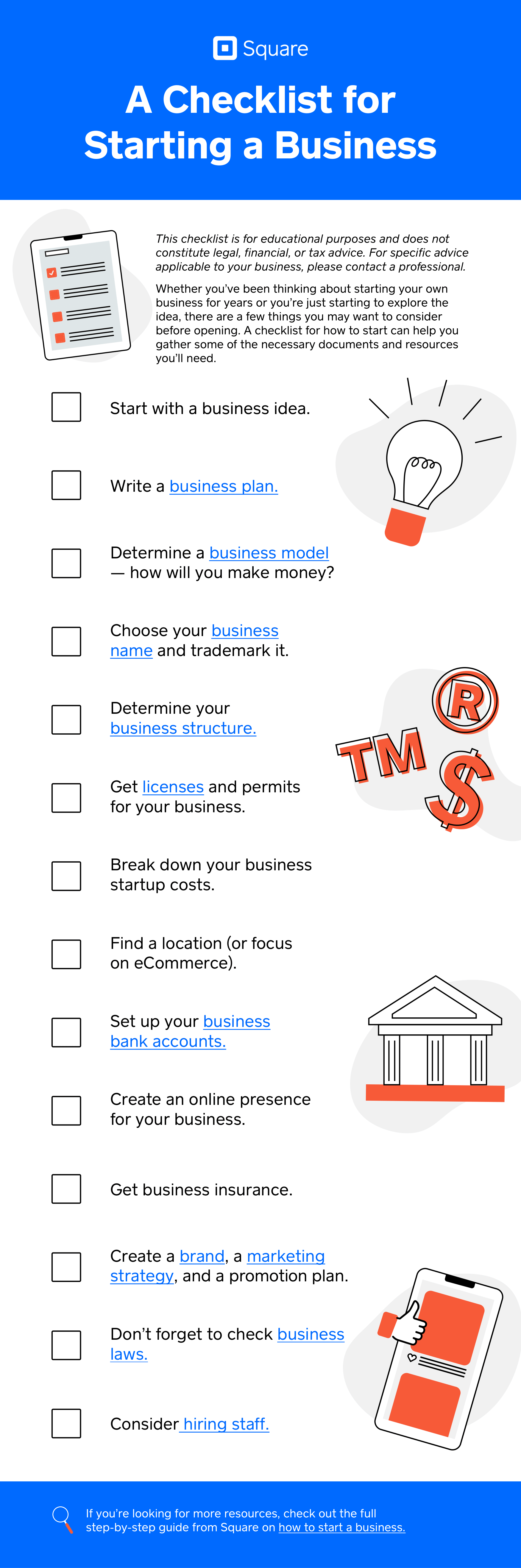

How To Start A Business Steps To Start Up A Business Square

/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

What Are Operating And Non Operating Activities Bdc Ca

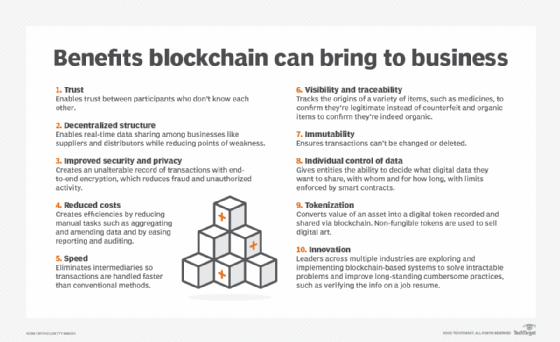

Top 10 Benefits Of Blockchain Technology For Business

Business Activity Code For Taxes Fundsnet

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Instructions For Form 8995 2021 Internal Revenue Service

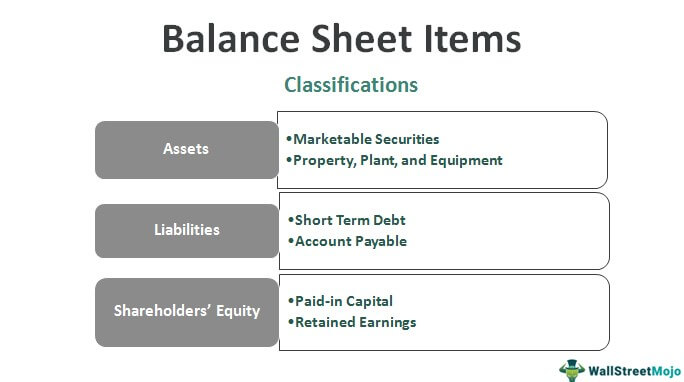

Balance Sheet Items List Of Top 15 Balance Sheet Items

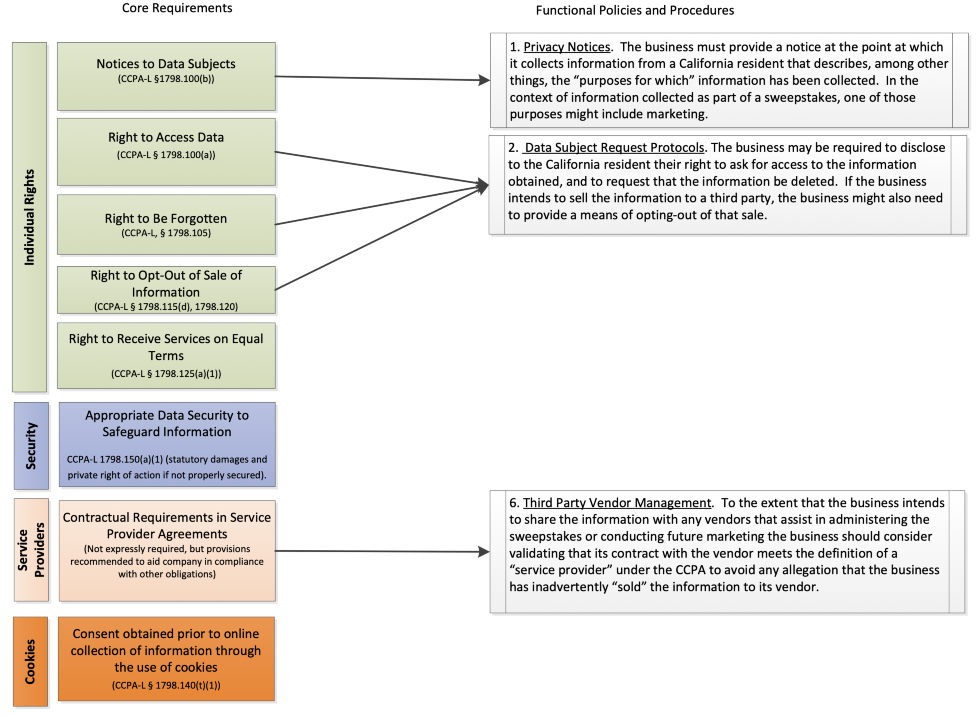

Definitions Bclp California Consumer Protection Act Information

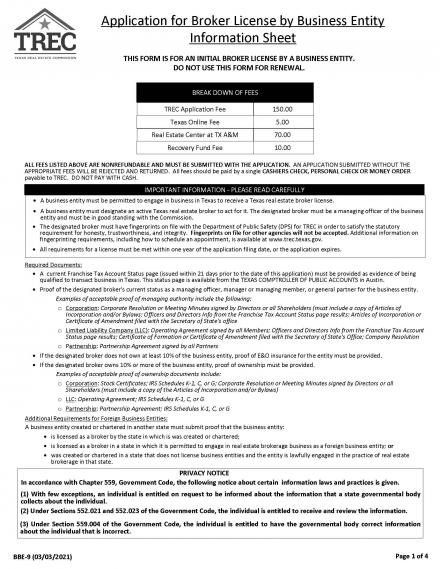

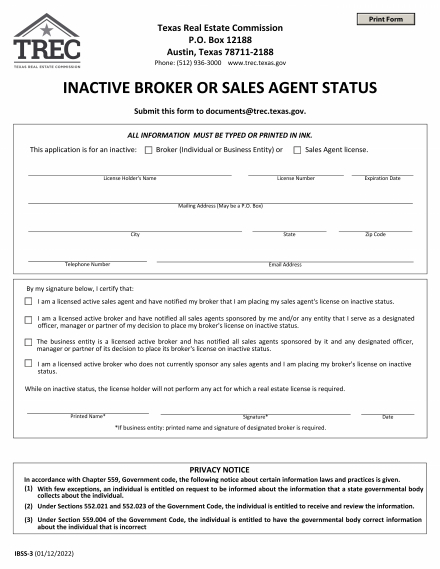

Application For Real Estate Broker License By A Business Entity Trec

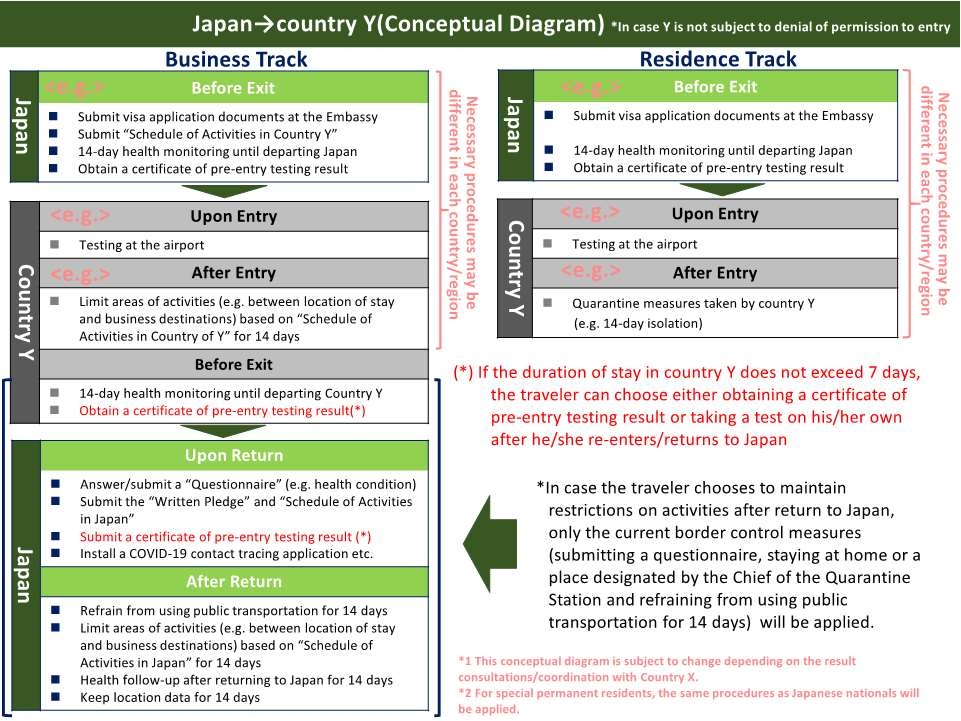

Procedures To Be Followed And Forms To Be Submitted For Entry Into Return To Japan Countries And Regions Which Are Not Subject To Denial Of Permission To Entry Travel Advice Warning On Infectious

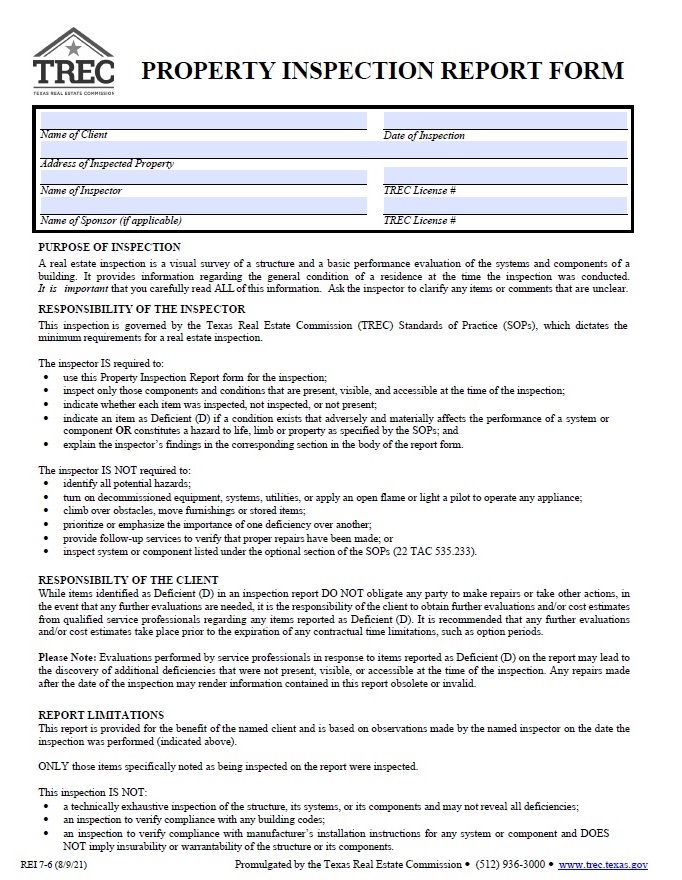

Become A Real Estate Inspector Trec

Application For Inactive Broker Or Sales Agent Status Trec

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/GENOte23saleonetimeitem-ef0a5df240b94d3c98042e62dca9b917.jpg)

Comments

Post a Comment